Rebranding Kotak Cherry

From Legacy Investment App to Trust-First Growth Platform

Business Context

Retail investing in India was experiencing rapid growth, with digital-first competitors like Groww and Paytm Money gaining market share through simplified, modern experiences.

Kotak had strong brand credibility but:

The legacy investment app felt visually outdated

Key journeys (especially SIP onboarding) had high drop-off

The experience did not reflect a digital-first positioning

Recurring investment adoption was underperforming

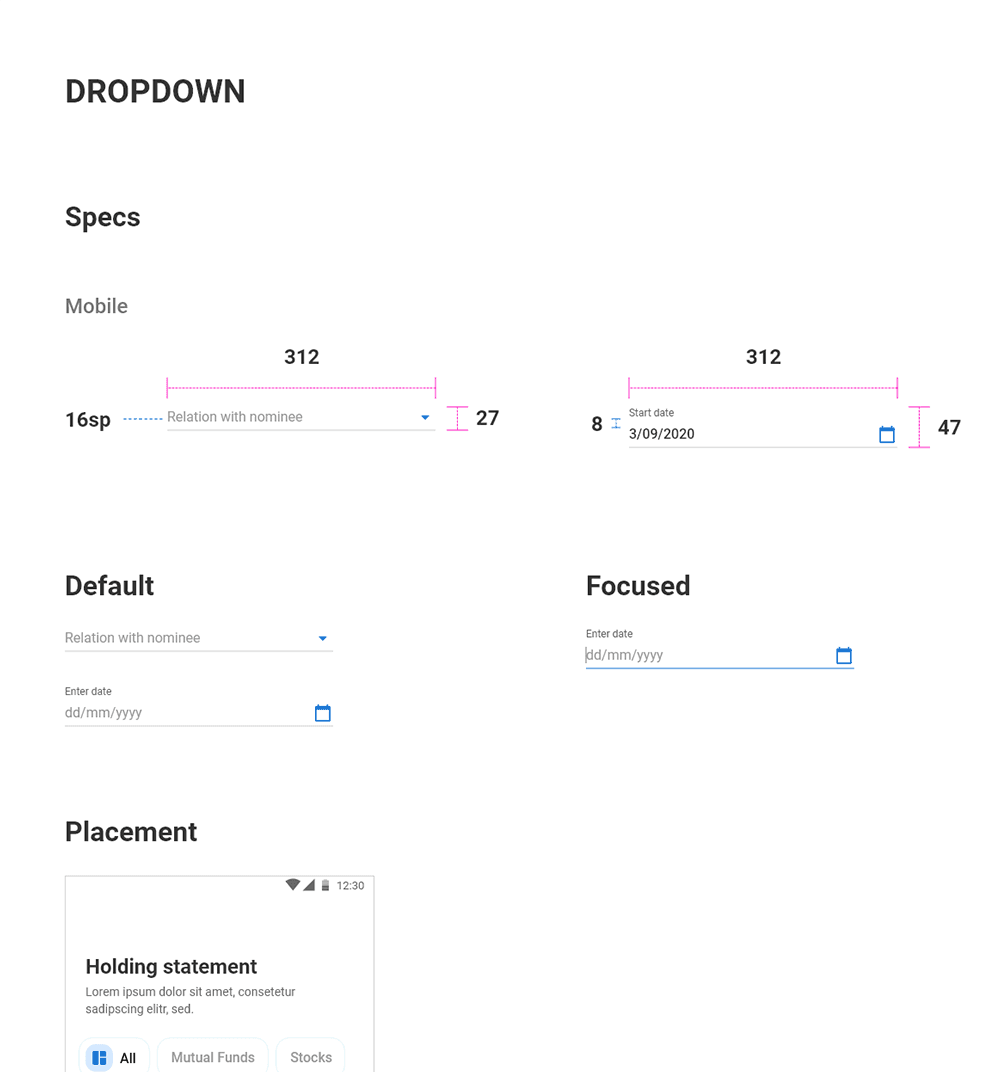

Legacy app screenshots

1.1 Business Objectives

Reposition Kotak Cherry as a modern, trustworthy investment platform

Increase SIP (Systematic Investment Plan) adoption

Reduce onboarding and mandate-stage drop-offs

Improve first-time investor confidence

Drive recurring AUM growth

This rebrand was not cosmetic—it was a strategic growth initiative.

My Role

I led

UX strategy for high-impact investment journeys (SIP, onboarding)

Behavioral research for recurring investments

Competitive benchmarking

Affinity synthesis and journey mapping

Interaction and visual redesign

Cross-functional alignment with product, growth, compliance, and engineering

Usability validation and iteration

Rebranding Strategy

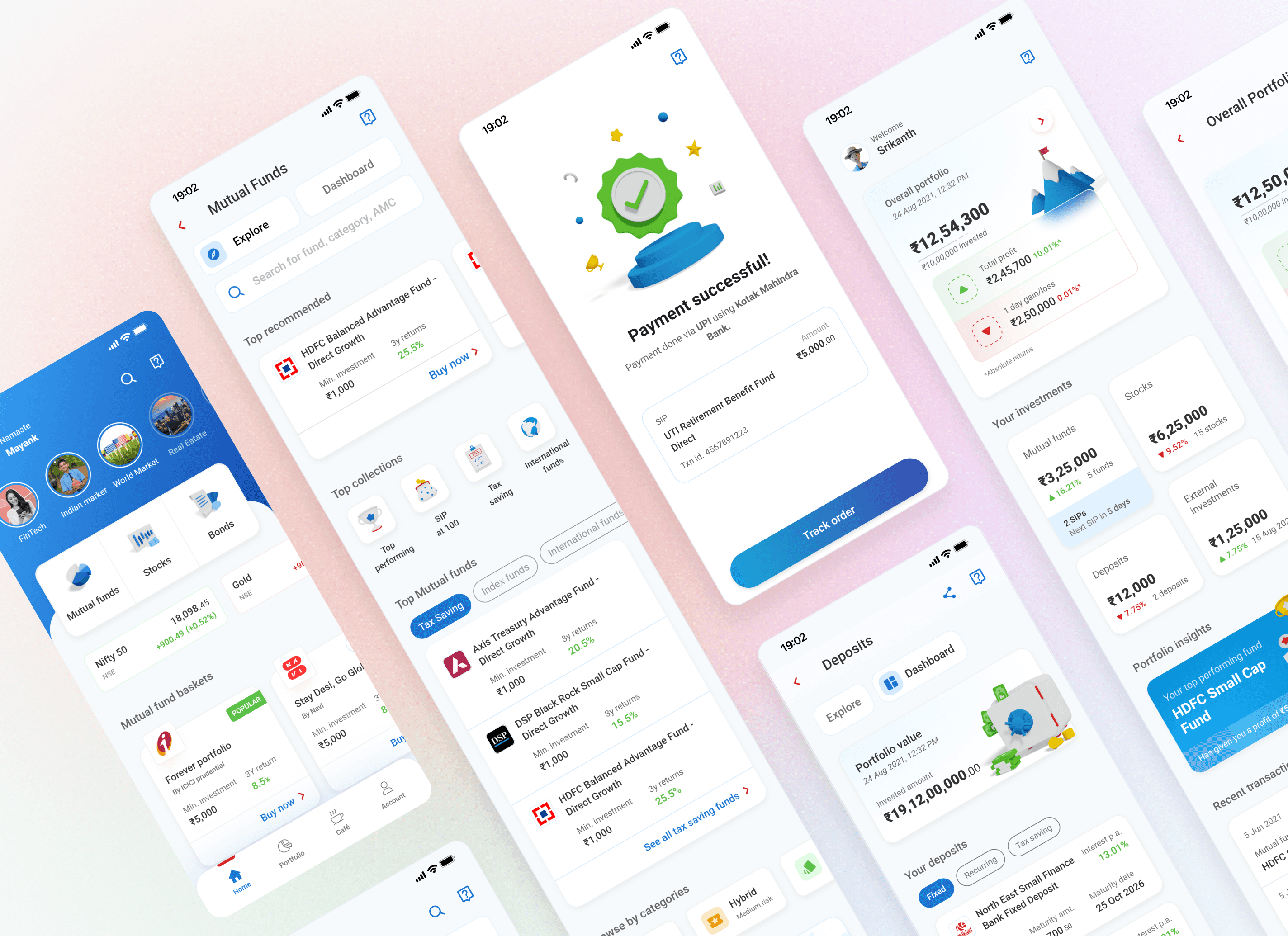

The rebrand focused on three strategic pillars.

3.1 Trust as a Visual Language

Clean gradient systems balancing modernity with financial credibility

Structured data presentation

Strong visual hierarchy

WCAG-compliant contrast ratios

Calm, purposeful micro-interactions

The goal was premium without intimidation.

3.2 Simplified Decision Architecture

We reduced cognitive overload by:

Introducing card-based fund discovery

Standardizing typography and spacing

Improving performance metric hierarchy

Creating modular, scalable design components

This improved clarity and reduced decision fatigue.

3.3 Behavioral Confidence in Investing

Research revealed that recurring investment anxiety—not complexity—was the primary barrier.

SIP became the core growth lever within the rebrand.

Research & Discovery

4.1 Methods

Secondary research (RBI mandate rules, SIP trends)

Competitive analysis (Groww, INDmoney, Kuvera, Paytm Money)

8 moderated interviews (age 24–38)

Low-fidelity prototype testing

Journey mapping & affinity clustering

4.2 Competitive Landscape & Opportunity

As part of discovery, I conducted a structured competitive teardown focused on two critical growth journeys:

Customer Registration (KYC + onboarding)

Mutual Fund purchase + SIP activation

Rather than high-level feature comparison, I analyzed:

Which apps automated steps to reduce onboarding friction

How seamlessly SIP setup was integrated within fund purchase

Mandate creation experience (UPI / Netbanking clarity, redirects, status feedback)

Depth and usability of SIP calculators

Fund comparison tools and decision support

4.3 Observations

Ecosystem-driven but comparatively complex navigation and mandate steps.

Optimized for speed. Minimal friction during fund discovery and SIP setup. Limited reassurance layers.

Strong data presentation and portfolio visibility. More information-heavy flows.

Advisory-oriented but dense information architecture.

4.4 Strategic Gap Identified

Most competitors optimized for transactional efficiency. Very few optimized for psychological reassurance during recurring commitment.

SIP is not just a transaction—it is a recurring financial promise.

This insight shaped our positioning:

Kotak Cherry would differentiate by balancing simplicity with confidence-building design.

This directly influenced the introduction of autopay education layers, deduction previews, and visible pause/edit controls.

4.5 Key Behavioral Insight

Users think in this order:

How much will go?

When will it go?

Can I stop it?

Is this safe?

The system was structured around compliance steps. Users were thinking about control and safety.

This mismatch caused abandonment.

Platform-Level Regulatory & Onboarding Constraints

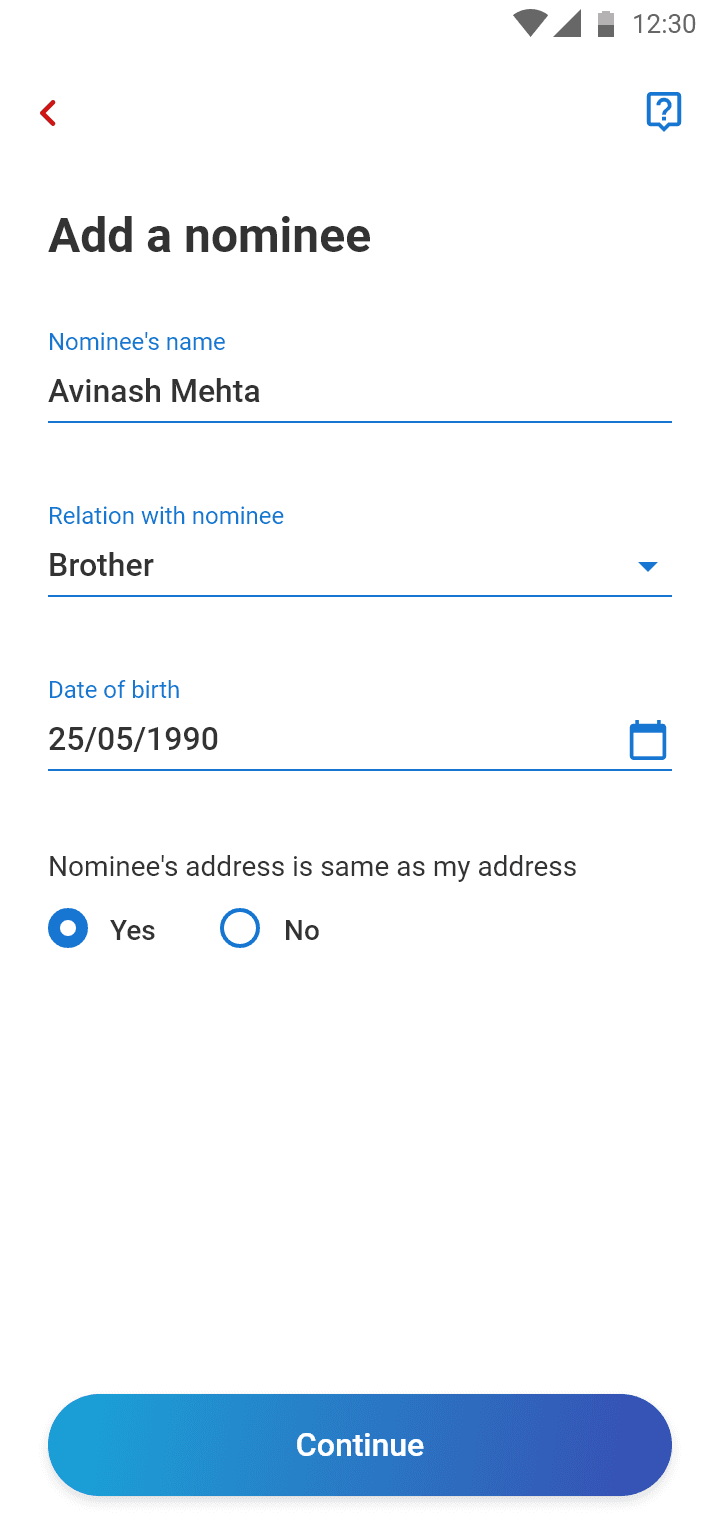

Before optimizing SIP specifically, we addressed broader regulatory and onboarding requirements that impacted all investment actions across the platform.

Regulatory requirements were non-negotiable:

Full KYC verification

Risk profiling questionnaire

Suitability mapping

FATCA declaration

Explicit consent architecture

Nominee capture (where mandatory)

Product wanted fewer steps. Compliance required completeness. Users wanted simplicity.

Removing steps was impossible. Reducing perceived effort was possible.

We could not remove regulatory steps. The opportunity was to restructure and sequence them to reduce perceived effort across the platform while protecting conversion.

Deep Dive: Optimizing SIP for Growth

6.1 Baseline Metrics

62% completion rate

High abandonment at autopay mandate stage

Average completion time: ~6.5 minutes

Trust rating: 3.1/5

SIPs directly contribute to predictable recurring revenue. Improving this flow had measurable financial implications.

6.2 SIP-Specific Growth Optimization Strategy

6.2.1 Autopay & Mandate Friction Reduction

Drop-off was highest at the autopay mandate stage. Users perceived automated deductions as loss of control.

To address this, we:

Introduced a dedicated autopay education layer

Made "Pause anytime" and "Modify anytime" explicit

Added clear transition states when redirecting to external mandate flows

This reframed SIP from a permanent commitment to a controllable recurring action.

6.2.2 Behavioral Risk Profiling Within Investment Intent

Responses mapped to backend risk categories. Legal and compliance approved revised wording.

We reframed as:

"How would you react if your investment drops 20%?"

Instead of technical jargon:

"Select your volatility tolerance"

6.2.3 Consent & Commitment Clarity During SIP Activation

Rather than scattered consent interruptions during investment confirmation, we:

Logically grouped disclosures

Used one primary consent with expandable details

Highlighted critical risk disclosures visually

Legal copy remained untouched. Layout reduced perceived burden while preserving regulatory integrity.

6.2.4 Intent-Based Sequencing for Conversion

Users could browse funds before triggering KYC completion.

Investment intent was built before regulatory friction appeared. Transaction gates remained fully compliant.

This improved the quality of users entering the SIP funnel and reduced early abandonment.

6.3 Mandate Flow Architecture & Drop-Off Prevention

Autopay setup required external verification through BSE Star and netbanking. This introduced a mandatory delay and a high-risk abandonment moment within the SIP funnel.

6.3.1 Key Challenges

Mandatory ~1 minute verification delay (compliance constraint)

External redirection for mandate authentication

Users dropping off mid-verification

Bank selection memory gaps on re-entry

Future mandate limit modification friction

Compliance preserved. Cognitive load reduced.

6.3.2 Design Decisions

6.3.2.1 Exit Rebuttal Layer (Back Navigation Interception)

When users attempted to exit during mandate setup, we introduced an educational rebuttal modal explaining autopay benefits (hassle-free, regular investing, secure). This reduced premature abandonment at a high-intent moment.

6.3.2.2 Conditional Bank Selection Logic

Supported multiple states:

First-time mandate setup

Additional mandate creation

Profile-triggered autopay setup

This ensured scalability without fragmenting the flow.

6.3.2.3 Future-Proofed Autopay Limit Design

Encouraged users to select a higher upper limit to prevent repeated authorization cycles when SIP amounts increased later. This reduced long-term compliance friction.

6.3.2.4 Countdown-Based Activation Screen

The mandatory wait time was reframed as a guided activation moment with a visible countdown, nudging users to complete verification immediately rather than postponing.

6.3.2.5 Multi-Session Recovery Handling

If users dropped off and returned later, we surfaced a bank-selection dropdown to resolve ambiguity about previously selected accounts. This handled state persistence and reduced rework.

6.4 SIP Usability Validation

Metric

Before

After

Completion Rate

62%

88%

Avg Completion Time

6.5 min

4 min

Trust Rating

3.1/5

4.3/5

6.5 SIP Business Impact

Increased SIP activation rate

Reduced mandate-stage drop-offs

Higher first-time investor conversion

Increased recurring AUM inflow

SIPs generate predictable recurring revenue. Improving completion created compounding growth impact.

Broader Product Optimization: Dashboard Clarity

While SIP optimization drove recurring revenue, the dashboard remained the highest-traffic screen and the first trust touchpoint after login.

7.1 Usability Findings

Testing revealed:

Users wanted immediate visibility of asset-class performance alongside overall returns

Top-tab navigation fragmented portfolio understanding

The hero card interaction (dropdown arrow) was unclear

Transaction status was not easily visible without deeper navigation

SIPs generate predictable recurring revenue. Improving completion created compounding growth impact.

7.2 Strategic Decision

Instead of incremental UI tweaks, we restructured the dashboard hierarchy:

Removed top-tab navigation and replaced it with contextual portfolio cards

Brought asset-class returns directly below overall portfolio value

Simplified hero card data hierarchy for faster scanning

Clarified transaction status messaging above the fold

Reduced ambiguous affordances

7.3 Outcome

The redesign improved first-impression clarity and reduced navigation friction, reinforcing the platform's trust-first positioning. The dashboard shifted from being informational to being confidence-building.

Stakeholder Leadership & Buy-In

To avoid aesthetic-only debates, I anchored discussions in:

Drop-off analytics

Behavioral research findings

Prototype walkthroughs

Compliance-preserving design proposals

When legal resisted consent restructuring, I demonstrated consent fatigue data and preserved exact legal copy while improving hierarchy.

When growth requested removing nominee capture, I negotiated "Remind me later" where legally permissible.

Alignment achieved across:

Product

Growth

Compliance

Engineering

Key Takeaway

In fintech, speed does not drive adoption, perceived control does.

By reframing onboarding from form completion to confidence building, we improved user trust, increased recurring investments, and contributed directly to revenue growth.